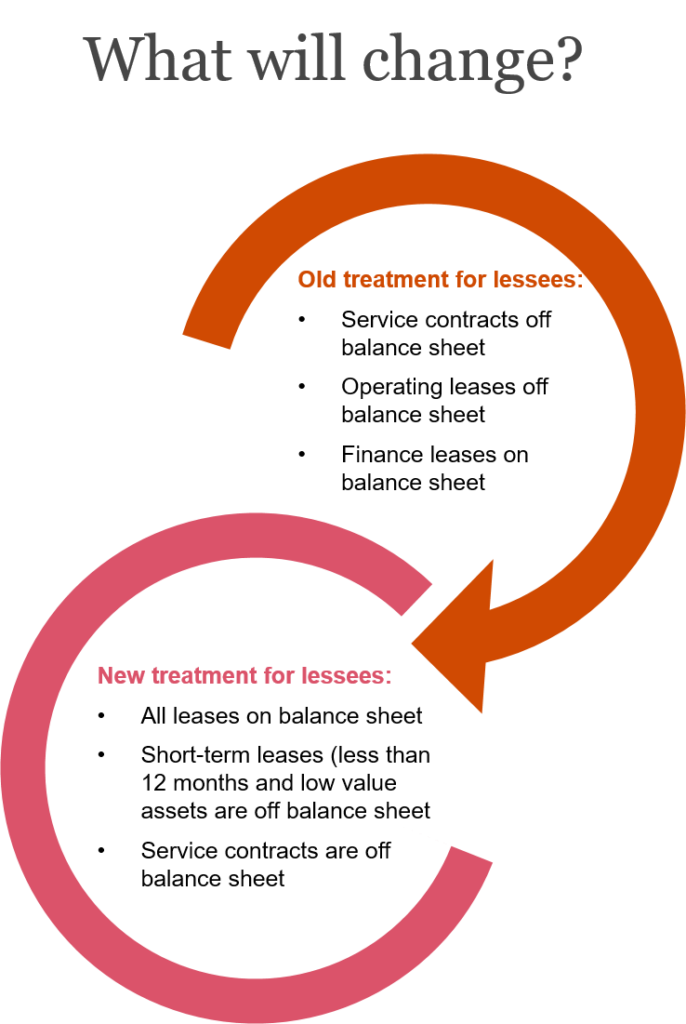

Leasing is an important financial solution used by many organisations. It enables companies to use property, plant, and equipment without needing to incur large initial cash outflows. Under existing rules, lessees generally account for lease transactions either as off-balance sheet operating or as on balance sheet finance leases. The new standard requires lessees to recognise nearly all leases on the balance sheet which will reflect their right to use an asset for a period of time and the associated liability to pay rentals. The lessor’s accounting model largely remains unchanged.

The new IFRS 16 requirements eliminate nearly all off-balance-sheet accounting for lessees, and impact many commonly used financial metrics such as gearing ratios and earnings before interest, tax, depreciation, and amortization (EBITDA). The changes are designed to make it easier for outsiders to compare the performance of different companies, but they may also affect credit ratings, borrowing costs, and even stakeholders’ perception of a company.

IFRS 16 is effective for annual reporting periods beginning on or after 1 January 2019, with earlier application permitted (as long as IFRS 15 is also applied).

The objective of the new standard is to report information that (a) faithfully represents lease transactions and (b) provides a basis for users of financial statements to assess the amount, timing and uncertainty of cash flows arising from leases. To meet that objective, a lessee should recognise assets and liabilities arising from a lease.

IFRS 16 introduces a single lessee accounting model and requires a lessee to recognise assets and liabilities for all leases with a term of more than 12 months, unless the underlying asset is of low value. A lessee is required to recognise a right-of-use asset representing its right to use the underlying leased asset and a lease liability representing its obligation to make lease payments.

At Pentagon Finance we help you implement the new standard and understand the impact to your overall financial reporting, we also help you identify and establish new processes required to ensure a smooth and effective transition into the new standard.