Top 5 Finance Transformation Challenges and how to overcome them

Introduction

Financial transformation is an essential part of business operations in today’s digital world. The challenge is that the process of transforming a company’s finances can be overwhelming and difficult to understand. Technology is playing an increasingly important role in finance transformation and the need to stay competitive requires businesses to remain up to date with the latest developments.

This article will discuss the top five financial transformation challenges and how to solve them using the latest technology. Read on to learn more about how to make the most of finance transformation in your business. Financial transformation is one of the biggest challenges businesses face today.

From implementing new technology to adjusting accounting processes, finance transformation can be daunting. Fortunately, there are ways to simplify and streamline the process. In this article, we’ll discuss the top 5 financial transformation challenges and how to solve them using innovative technology and tailored finance transformation solutions. Keep reading to learn more!

1 Define the problem

Before any organization can begin to tackle its financial transformation challenges, it must first determine the root cause of its issue. While there may be various areas of financial operations that need improvement, such as process optimization or ERP implementation, organizations must break down the larger problem into smaller, more manageable components. Common areas of financial transformation include Purchase to Pay (P2P), Order to Cash (O2C), and Record to Report (R2R). Understanding the specific challenges posed by each area is the first step in financial transformation.

For example, a company’s P2P process may need to be optimized in order to reduce errors, delays, and costs associated with manual processing. Or an organization’s O2C process may need to be reworked to speed up customer payments. Finally, an R2R system could be improved to provide more timely and accurate information for stakeholders. Once the challenges have been identified and defined, organizations can move forward with finding solutions.

2 Finding the right solution

The key to financial transformation is identifying the right solution for your business. While it’s important to consider process optimization and technology, organizations must also look at how they can strengthen their current financial operations and internal controls.

One of the most common solutions for financial transformation is an ERP implementation. This is a comprehensive system that helps manage all of your core business processes. It can provide visibility into your purchase-to-pay, order-to-cash, and record-to-report, and month-end cycles, allowing you to gain insight into the overall financial performance of your organization. An ERP solution such as Oracle, Oracle NetSuite, SAP, AccountsIQ etc can also help optimize financial processes, reduce errors and manual work, and provide better control over finances.

Another option is leveraging existing technologies to improve existing processes. Solutions like cloud accounting, mobile payments, and advanced analytics can automate and streamline processes, allowing for improved efficiency and accuracy in your financial operations.

Whatever solution you choose for your financial transformation project, make sure that you have the right tools in place to ensure success. By investing in the right solutions and resources, you can transform your finance team from reactive to proactive and drive lasting success.

3 Implementing the solution

Once you have identified the problem and found the right solution, it’s time to implement it. This is an important stage as it determines the success of the overall financial transformation project. It’s important to ensure that your team is well-prepared and understands the scope and expectations of the project before implementation.

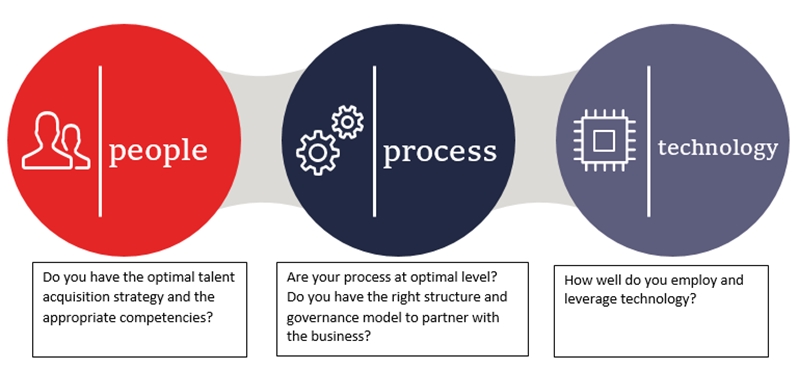

People: Invest in training for your staff and ensure everyone has the skills to use the new system effectively. Having a clear plan with defined roles and responsibilities helps ensure everyone is working towards the same goal.

Process Optimization: Make sure you optimize existing processes to reduce the time and costs associated with the project. Streamlining processes can reduce complexity and increase efficiency while helping the project meet its goals.

Purchase to Pay: If you are implementing a purchase-to-pay process, it’s important to create a central repository for all purchase orders, invoices, and receipts. Having all of these documents stored in one place makes it easier for staff to locate information when needed.

Order to Cash: Implementing an order-to-cash process can streamline customer invoicing, payments, and collections. Automating these processes helps improve customer service and increases accuracy.

Record to Report: Ensure all financial data is accurately captured and reported. Implementing a robust record to report process helps ensure that all financial records are up to date, accurate, and compliant.

ERP Implementation: Utilizing an enterprise resource planning (ERP) system is essential for successful financial transformation. An ERP system integrates all of your business functions into one platform, making it easier to manage operations, improve accuracy, and monitor performance.

There are many more processes. factors and taxonomies not covered above, however these factors are not necessarily linear in nature but dependent on your problem statement as outlined in section (1) above, the value created post transformation and outcome of your transformation would heavily depend on the expertise you have deployed through the various stages and phases of your transformation process.

4 Measuring success

Measuring the success of your financial transformation is key to ensuring that the changes are having a positive impact. When defining success metrics, it is important to consider both hard metrics such as costs, efficiency and accuracy as well as softer metrics related to culture, such as employee satisfaction.

Hard metrics may include measuring cost savings through process optimization or improvements in operational efficiency. Examples of process optimizations include Purchase-to-Pay, Order-to-Cash and Record-to-Report. It is also important to measure the success of any ERP implementation and the impact it has on organizational performance.

Soft metrics related to culture can be difficult to measure but are just as important for evaluating the success of your financial transformation. It is important to look at employee engagement, customer satisfaction and other measures of morale. You should also measure the effectiveness of any change management initiatives, such as training and communication efforts.

Ultimately, success should be measured in terms of how well the transformation meets your original objectives. Was the goal to increase efficiency? Cut costs? Improve customer service? All of these objectives should be tracked to ensure that you are reaching your desired goals.

5 Sustaining success

Once a financial transformation solution is implemented, it’s important to ensure the process is optimized and running smoothly. Process optimization includes things such as Purchase to Pay, Order to Cash, Record to Report, and ERP Implementation. Ensuring these processes are optimized helps to ensure that your business has a sustainable financial transformation solution.

One of the keys to sustaining success is to have the right people in place who understand and are committed to the new system. This means making sure that everyone involved in the process understands their roles and responsibilities and is willing to commit to the changes that have been implemented. Regular training and communication should be held to keep everyone on track and motivated to maintain the system.

Regular reviews of the system should also take place. This will help identify any potential issues and enable corrective action to be taken. It is important to continuously monitor performance indicators to ensure that the system is performing optimally.

By following these steps, you can ensure that your financial transformation solution remains successful in the long term. Implementing a successful financial transformation solution requires dedication and ongoing commitment. By staying on top of the process, you can guarantee that your solution is always running efficiently and producing positive results.

In Summary, the challenge of finance transformation isn’t the why?, but the how?.

Speak to our specialist advisory team to help you understand your “how” and how best to simplify your unique challenges.